What is financial planning and does is it only apply to personal finance, what about for businesses?

Financial planning is the process of creating a detailed and optimised strategy to manage finances, accomplish financial ambitions, and ensure enduring financial stability. Though often associated with personal finance, the principles of financial planning are equally crucial for businesses. In both contexts, financial planning involves analyzing current financial positions, setting realistic objectives, and devising strategies to achieve those goals.

Personal Financial Planning

For individuals, financial planning encompasses numerous aspects of financial life, from managing day-to-day expenses to preparing for retirement. Key components of personal financial planning include:

- Budgeting: Creating a monthly plan to allocate income towards expenses, savings, and debt repayment.

- Emergency Fund: Establishing a safety net for unexpected expenses or financial setbacks.

- Investment Planning: Choosing suitable investment options to grow wealth based on risk tolerance and time horizon.

- Retirement Planning: Preparing for a financially secure retirement through savings plans like pensions, ISAs, and other investment vehicles.

- Tax Planning: Strategically managing tax liabilities to maximise after-tax income.

Effective personal financial planning helps individuals gain control over their finances, reach their financial goals, and establish long-term security for themselves and their families.

Business Financial Planning

For businesses, financial planning is integral to making informed decisions, optimising resources, and driving profitability and growth. The fundamental aspects of business financial planning include:

- Budgeting and Forecasting: Developing financial models to predict future income, expenses, and profitability. This process helps businesses align their financial goals with their operational capabilities.

- Cash Flow Management: Ensuring the company has sufficient liquidity to meet its short-term obligations and invest in growth opportunities.

- Capital Structure Planning: Determining the optimal mix of debt and equity financing to support business activities.

- Risk Management: Identifying, assessing, and mitigating financial risks to protect the company’s assets.

- Tax Planning: Strategically managing tax obligations to enhance after-tax profits and ensure compliance with UK tax regulations.

By engaging in comprehensive financial planning, businesses can navigate economic uncertainties, capitalise on growth opportunities, and sustain long-term success.

Bridging Personal and Business Financial Planning

Though distinct, personal and business financial planning share common objectives: achieving financial stability and attaining specific financial goals. For entrepreneurs and small business owners, the line between personal and business finances can often blur. Effective planning ensures that personal financial health does not compromise business growth and vice versa.

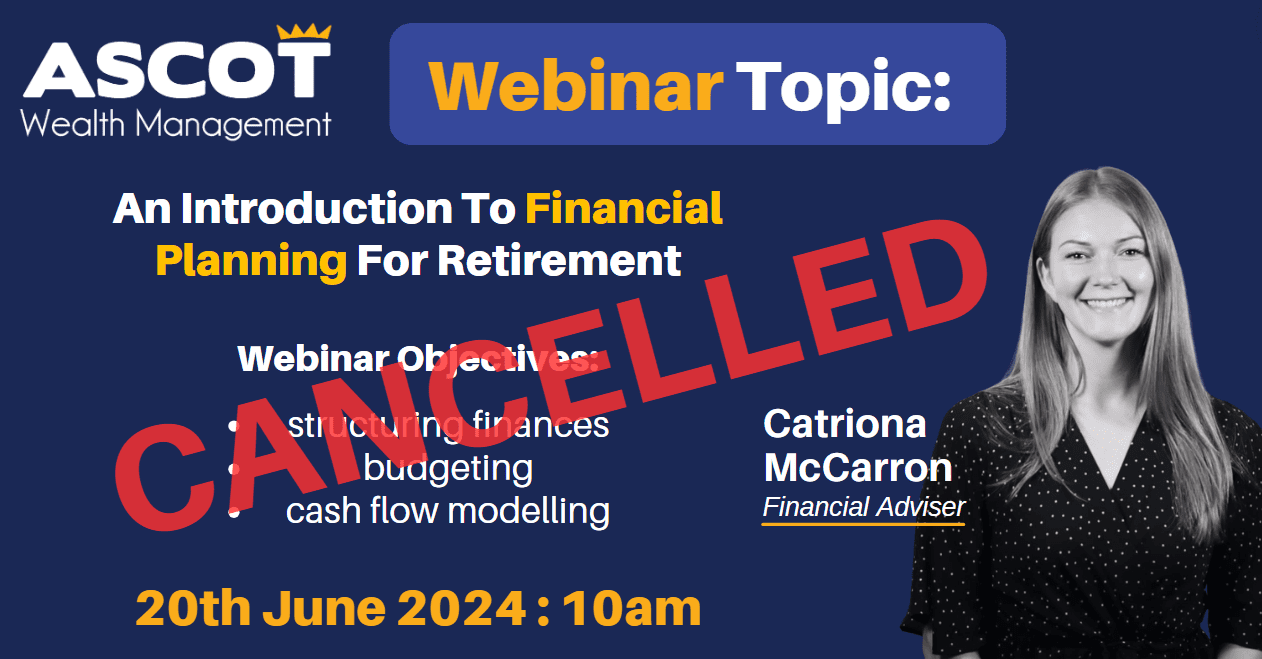

Why Choose Professional Financial Planning Services?

Engaging professional wealth management services offers several advantages for individuals and businesses:

- Expertise: Wealth management professionals provide insights and strategies tailored to individual or business needs.

- Strategic Planning: Customised financial plans crafted to meet specific objectives.

- Resource Optimisation: Efficient management of resources to maximise potential returns and growth.

- Long-Term Stability: Focused strategies to ensure enduring financial health and resilience against uncertainties.

At Ascot Wealth Management, we pride ourselves on being a trusted and authoritative source in the wealth management industry in the UK. Our team of seasoned financial advisors and planners is dedicated to helping high net worth individuals, families, and businesses achieve their financial aspirations through bespoke and informed financial planning.