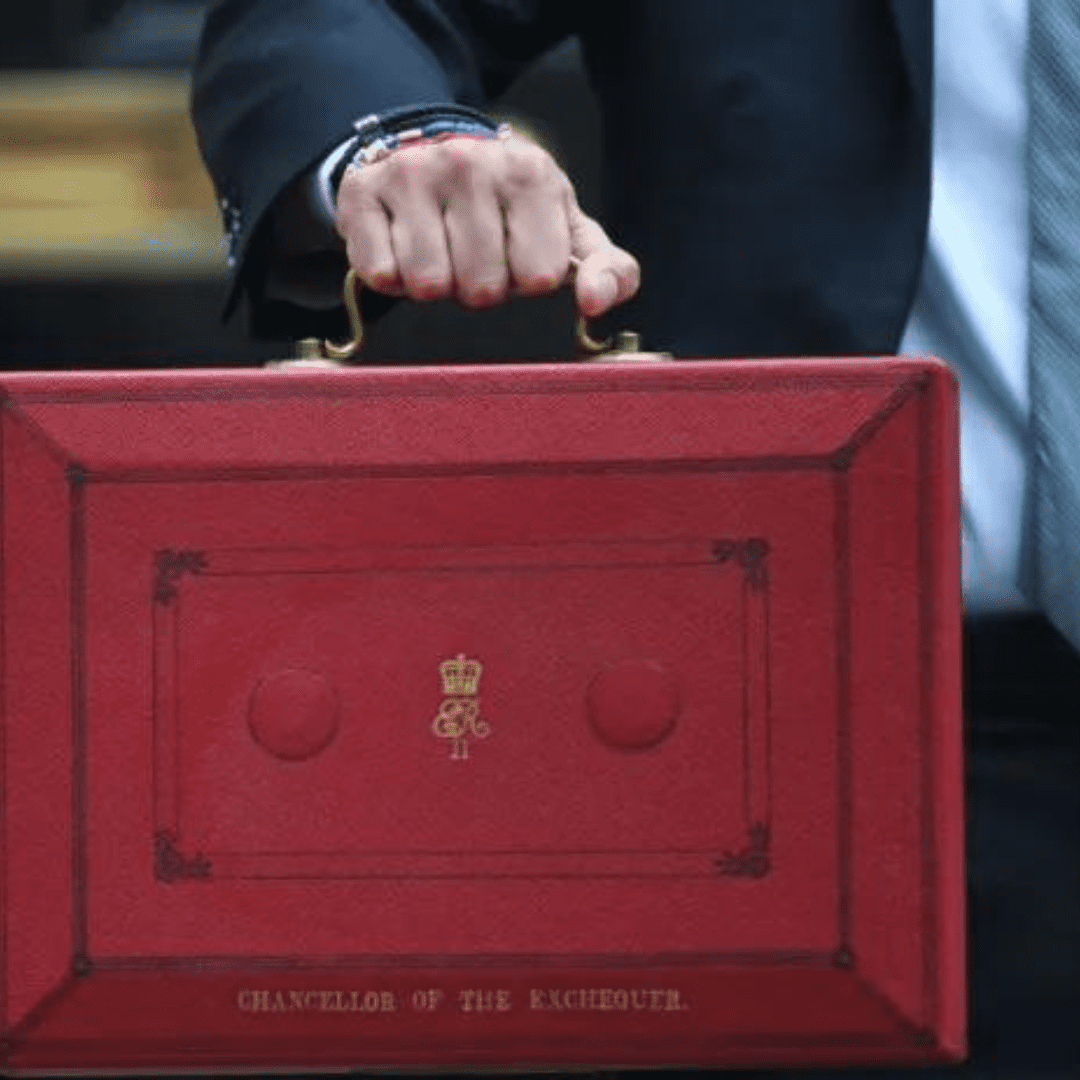

The Autumn budget has been key to show how this government, with Rishi Sunak at the helm, will aim to stabilise markets and fund the high levels of spending we have seen over the previous few years due to worldwide events such as COVID-19.

A summary of the key changes are as follows:

Changing the allowances for dividend and capital gains tax will increase the tax revenues received by the government, as dividend tax allowance will be halved, to £1,000 by 23/24 tax year and halved again to £500 for 24/25 tax year. Capital gains tax (CGT) allowance will reduce from £12,300 to £6,000. According to government policy papers, even when accounting for implementation costs, the reduction in these allowances will significantly increase tax revenues year on year.

For most people, CGT and dividend allowance changes will have little impact, as with careful financial planning the tax can be minimised, for example through tax efficient wrappers such as ISAs or pensions. In some cases, for those with larger investments, alternative planning strategies may work, such as onshore or offshore bonds, or EIS investments.

Married couples can also utilise spousal benefits, which include being able to transfer money freely between the couple without being taxed. This means if one person in the couple has fully utilised their dividend and CGT allowances, they could transfer funds to their partner. If the partner has not utilised all their allowances, then they could sell the funds to realise the gains in their name, to reduce or even eliminate the tax liabilities on those funds.

The only change to income tax is a that the additional rate threshold is reducing from £150,000 to £125,140. This will increase the number of people paying the 45% tax on some income. While increasing tax revenues, this will only impact higher earners, and have minimal impact on savings and investments unlike the previous tax changes mentioned.

National insurance contributions eventually determine the level of state pension you are eligible for. Changes are being made to the class 3 voluntary contributions, which are currently £15.85 a week and rising to £17.45. This increases the cost for one year by £83.20. Additionally, a new rule is being implemented, limiting individuals to only being able to buy 6 years of historical gaps in your NIC history. This may reduce the number of people being eligible for a full state pension if they do not keep up with their national insurance contributions. In this case, careful planning will help to ensure all payments are made to keep an individual eligible for full state pension on their set retirement age.

The final key change is to stamp duty land tax (SDLT). The tax-free threshold has been increased from £300,000 to £425,000 for first time buyers, which will help more people get onto the property ladder especially given rising house prices. Additionally, SDLT entry price has increased from £125,000 to £250,000. For an individual buying a £250,000 property this would save £2,500 in SDLT. This will also be fixed until 31st March 2025.

These changes in the Autumn budget have been key for the government to show the public that UK spending is affordable, whilst minimising the potential effects on economic growth. It has made financial planning even more important, as in most cases individuals and couples will be liable to more tax unless they start using further tax planning strategies. These mitigation techniques were also discussed further by one of our advisers, Catriona, in the recent webinar. If you are looking for any advice or a further discussion on this, then please reach out to us for a meeting.

Written by: Alice Frost

Date: 16 December 2022

Copyright © 2022 | All rights reserved.

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference number 551744.

Ascot Wealth Management Limited is a registered limited company. Company Number: 07428369